When people discuss the impacts of climate change, they're often talking about its global impacts. They talk about the polar ice caps that are melting because of climbing temperatures and the diminishing sizes of inland lakes. They're not talking about the impacts of climate change on the average person.

The severity of climate change is often ignored or dismissed because it seems like a far-away problem. Why would melting ice caps affect your life? Why would the size of a lake matter? Why would hotter/colder temperatures impact your day-to-day life, other than how you dress when you go outside?

The truth is that climate change's large-scale problems will have small-scale impacts. As an individual, you will feel the ripple effects, especially when it comes to your finances.

How Will Climate Change Affect Your Finances?

Hotter Summers

Climate change will make the summer months hotter. Expect record-breaking heat waves throughout the season, and even in spring and fall. How will this affect your finances? You'll spend more energy-and therefore more money-on indoor temperature control in order to compensate for the heat outdoors. You'll want to keep your air conditioning running at all hours.

And you shouldn't ignore your air conditioning during heat waves to save yourself some money - this could lead to heat stroke.

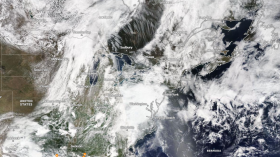

Colder Winters

While summers are getting hotter, winters are getting colder. You can also expect to spend more money on heating your home throughout the season.

Frigid temperatures can also cause more household problems, like ice dams on the roof, frozen pipes and burst pipes. You'll need to carefully winterize your house before the cold weather strikes or risk paying for emergency repairs and services.

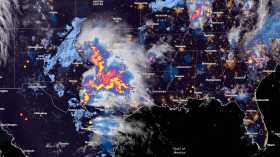

More Storms

Storms are getting more frequent and more severe. You can expect to endure more rainstorms, snowstorms and hurricanes in the upcoming years. These can cause expensive damages to your property. Your basement might flood after a heavy rainstorm, or a tree branch could fall onto your car during a hurricane.

More Wildfires

Climate change can lead to more droughts, which increases the risk of wildfires. Some experts have even warned that there will be a global wildfire crisis in the future if climate change is not addressed quickly enough.

Wildfires are incredibly dangerous and pose a serious threat to their surroundings. If your home is in the path of a wildfire, you could lose it and all of the belongings inside of it. Not to mention, the poor air quality caused by the fire could put you into the hospital, leaving you with steep medical bills.

How Can You Prepare Your Finances for Climate Change?

Set Up an Emergency Fund

One of the first things that you should do is set up an emergency fund for your household. An emergency fund can help you cover unplanned, urgent expenses immediately. Simply withdraw the necessary savings from your account and make your payment.

You can use your emergency fund to manage small but important repairs, like patching up your roof after a rainstorm caused a leak, fixing up your A/C unit in the midst of a heatwave or fixing your furnace in the midst of a cold snap.

Have a Backup Plan

You should have a financial backup plan set up in case you don't have enough savings in your emergency fund. One backup plan option that you can set up is a credit card. With a credit card, you can cover an emergency expense quickly and focus on paying down the card's balance afterward. Keep your card's balance as low as possible so that you have enough available credit to cover a transaction at a moment's notice.

Another credit tool that you could use as a backup plan is a line of credit. With an approved line of credit, you can request a withdrawal within your limit and use the funds to cover the emergency expense. Then, you can put your efforts toward replenishing the account balance.

What if you don't have a line of credit? You can apply for line of credit loans online as long as you meet all of the qualifications. You just might get approved for one.

Get Insurance

Your homeowners insurance can offer some coverage for problems related to climate change (for instance, if your basement floods after a frozen pipe bursts in the winter) but not for natural disasters. You will want to get supplemental insurance for disasters like hurricanes, wildfires and overland floods.

What disasters should you protect yourself from? It all depends on your location. If you live in a state that's at high risk of wildfires, like California, you'll want to get coverage for that disaster. Look at FEMA's (Federal Emergency Management Agency) natural risk index to see which disasters you're likely to encounter.

Climate change isn't a problem that's going to disappear in the next few years. So, it's best to prepare your finances for its impacts.

© 2024 NatureWorldNews.com All rights reserved. Do not reproduce without permission.

* This is a contributed article and this content does not necessarily represent the views of natureworldnews.com

![Venomous Centipede Could be Game-Changer and Save Lives of People with Kidney Disease [Study]](https://1471793142.rsc.cdn77.org/data/thumbs/full/70407/280/157/50/40/venomous-centipede-could-be-game-changer-and-save-lives-of-people-with-kidney-disease-study.jpg)